Price Comparison Tool Required for 2023 Plan Years

Effective for plan years beginning on or after Jan. 1, 2023, group health plans and health insurance issuers must make an internet-based price comparison tool available to participants, beneficiaries and enrollees. This requirement comes from final rules regarding transparency in coverage (TiC Final Rules) that were issued by the Departments of Labor, Health and Human Services and the Treasury (Departments) in November 2020.

Effective for plan years beginning on or after Jan. 1, 2023, group health plans and health insurance issuers must make an internet-based price comparison tool available to participants, beneficiaries and enrollees. This requirement comes from final rules regarding transparency in coverage (TiC Final Rules) that were issued by the Departments of Labor, Health and Human Services and the Treasury (Departments) in November 2020.

According to the Departments, this tool will provide consumers with real-time estimates of their cost-sharing liability from different providers for covered items and services, including prescription drugs, so they can shop and compare prices before receiving care.

The TiC Final Rules require health plans and issuers to provide this information in paper form upon request. In addition, plans and issuers should be prepared to provide this comparison information over the telephone to comply with a transparency requirement added by the Consolidated Appropriations Act, 2021 (CAA).

Action Steps

Most employers will rely on their health insurance issuers or third-party administrators (TPAs) to develop and maintain the price comparison tool and provide related disclosures in paper or over the phone upon request.

Employers with fully insured health plans should confirm that their health insurance issuer will comply with the price comparison tool requirements, beginning with 2023 plan years, and ensure this compliance responsibility is reflected in a written agreement. Similarly, employers with self-insured plans should reach out to their TPAs (or other service providers) to confirm they will be in compliance by the deadline and update agreements, as necessary, to reflect this responsibility.

Price Comparison Tool (TiC Final Rules)

The Tic Final Rules require group health plans and health insurance issuers in the individual and group markets to make an internet-based self-service tool available to participants, beneficiaries and enrollees to disclose personalized price and cost-sharing liability for all covered health care items and services, including prescription drugs. This tool must be available without a subscription or other fee. Also, upon request, group health plans and issuers must make this information available in paper form.

Deadlines

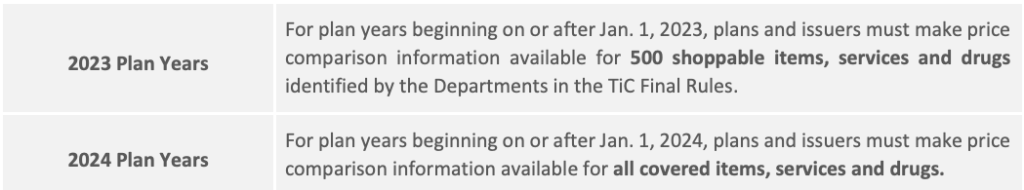

The self-service price comparison tool must be available by the following phased-in deadlines:

Accordingly, group health plans with a calendar year plan (Jan. 1-Dec. 31) must make a price comparison tool available beginning Jan. 1, 2023, for the 500 shoppable items and services identified in the TiC Final Rules.

Affected Plans

Group health plans, including self-insured plans and level-funded plans, and health insurance issuers of individual and group coverage are subject to the price comparison tool requirement. However, grandfathered health plans, excepted benefits (for example, limited-scope dental and vision benefits) and short-term, limited-duration insurance (STLDI) are NOT required to provide the price comparison tool. In addition, account-based group health plans, such as HRAs and health FSAs, and HSAs are not subject to the price comparison tool requirement.

Special Rules Group Health Plans

The TiC Final Rules include the following special provisions for group health plans to avoid unnecessary duplication:

- Employers with fully insured health plans: According to the preamble to the Tic Final Rules, the Departments assume fully insured group health plans will rely on issuers to develop and maintain the price comparison tool and provide any requested disclosures in paper form. Accordingly, the Final Rules provide that an employer with a fully insured health plan is not required to provide the price comparison tool if the health insurance issuer agrees in writing to provide the tool. If this written agreement is in place and the issuer fails to provide a compliant price comparison tool, the issuer (and not the plan) will violate the TiC Final Rules’ transparency requirements.

- Employers with self-insured health plans: The Departments assume that most self-insured group health plans will rely on other parties, such as TPAs and pharmacy benefit managers (PBMs), to develop and maintain price comparison tools. Accordingly, the Final Rules allow employers with self-insured plans (including level-funded plans) to contract with another party, such as a TPA or PBM, to provide the required tool. However, these employers must monitor their service providers to ensure they provide the required cost-sharing disclosures and remain liable for compliance with the Final Rules.

How the Tool Works

According to the Departments, the price comparison tool will enable individuals to obtain real-time, accurate estimates of their potential cost-sharing liability for covered items and services they might receive from different providers. Having access to this information will allow them to understand and compare health care costs before receiving care.

The price comparison tool must allow users to search for cost-sharing information for a covered item or service by entering certain information: a billing code or descriptive term (for example, “rapid flu test”); the in-network provider’s name if a user wants cost-sharing information for a specific in-network provider; and certain other relevant factors, such as the location of service, facility name or dosage. The price comparison tool must provide real-time responses based on cost-sharing information that is accurate at the time of the request. Responses must include the following information:

- An estimate of the individual’s cost-sharing liability for the covered item or service;

- The individual’s accumulated amounts (that is, the amount of financial responsibility the individual has incurred at the time of the request, with respect to a deductible or an out-of-pocket limit);

- The in-network rate;

- The out-of-network allowed amount if the request for cost-sharing information is for a covered item or service furnished by an out-of-network provider;

- For items or services subject to a bundled payment arrangement, a list of the items and services included in the bundled payment arrangement for which cost-sharing information is being provided;

- A notification, whenever applicable, that coverage of a specific item or service is subject to a prerequisite (for example, prior authorization, concurrent review or step therapy);

- A disclosure notice that communicates certain information in plain language, such as a statement about the possibility of balance billing from out-of-network providers and a statement that the cost-sharing estimate is not a guarantee that benefits will be provided for that item or service. Note that the Departments have developed a draft model disclosure that plans and issuers can use (but are not required to use) for these disclosure requirements.

Privacy Concerns

The TiC Final Rules do not make any changes to federal and state privacy laws that apply to group health plans and health insurance issuers, including the Health Insurance Portability and Accountability Act of 1996 (HIPAA). The Departments acknowledge that some of the content that must be disclosed under the TiC Final Rules may be “protected health information” subject to HIPAA’s privacy, security and breach notification rules. Health plans and issuers must continue to comply with HIPAA and other applicable state or federal privacy laws when disclosing information, including restrictions on who may have access to personalized cost-sharing information.

Interaction With CAA’s Price Comparison Tool

The CAA, which was signed into law on Dec. 27, 2020, includes a number of requirements for group health plans and health insurance issuers intended to increase transparency in health care and eliminate surprise medical bills. Similar to the TiC Final Rules, the CAA requires plans and issuers to make a “price comparison tool” available on the plan’s or issuer’s website. The CAA also requires plans and issuers to provide price comparison guidance by telephone, upon request, to individuals enrolled in coverage.

Duplication and Telephone Requirement

According to a series of FAQs from Aug. 20, 2021, the Departments intend to issue proposed rules addressing whether compliance with the TiC Final Rules’ price comparison tool satisfies the CAA’s price comparison requirements. The CAA adds a requirement not imposed under the TiC Final Rules: Price information must be provided over the telephone upon request. The Departments intend to propose that the same pricing information available through the online tool or in paper form must also be provided over the telephone upon request.

Enforcement Delay

The CAA’s price comparison requirement is effective for plan years beginning on or after Jan. 1, 2022. However, in the FAQ guidance, the Departments recognize that the price comparison methods required by the CAA are largely duplicative of the price comparison tool required by the TiC Final Rules. The Departments also realize plans and issuers have been expecting to implement the first phase (500 items and services) for plan years beginning on or after Jan. 1, 2023. Accordingly, the Departments will not enforce the requirement that a plan or issuer makes available a price comparison tool (by internet website, in paper form or by telephone) for plan years beginning before Jan. 1, 2023.